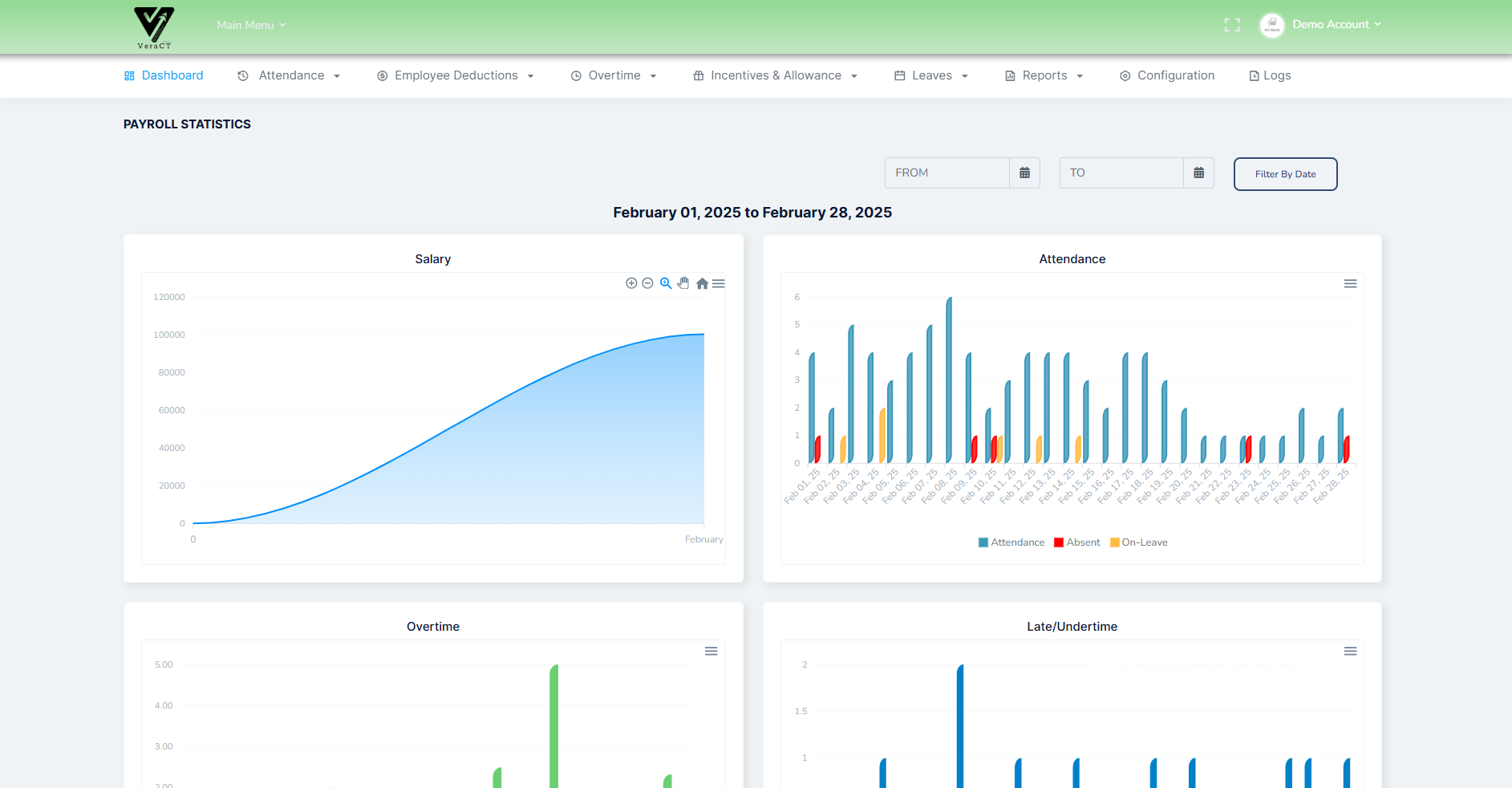

What is a Payroll Management?

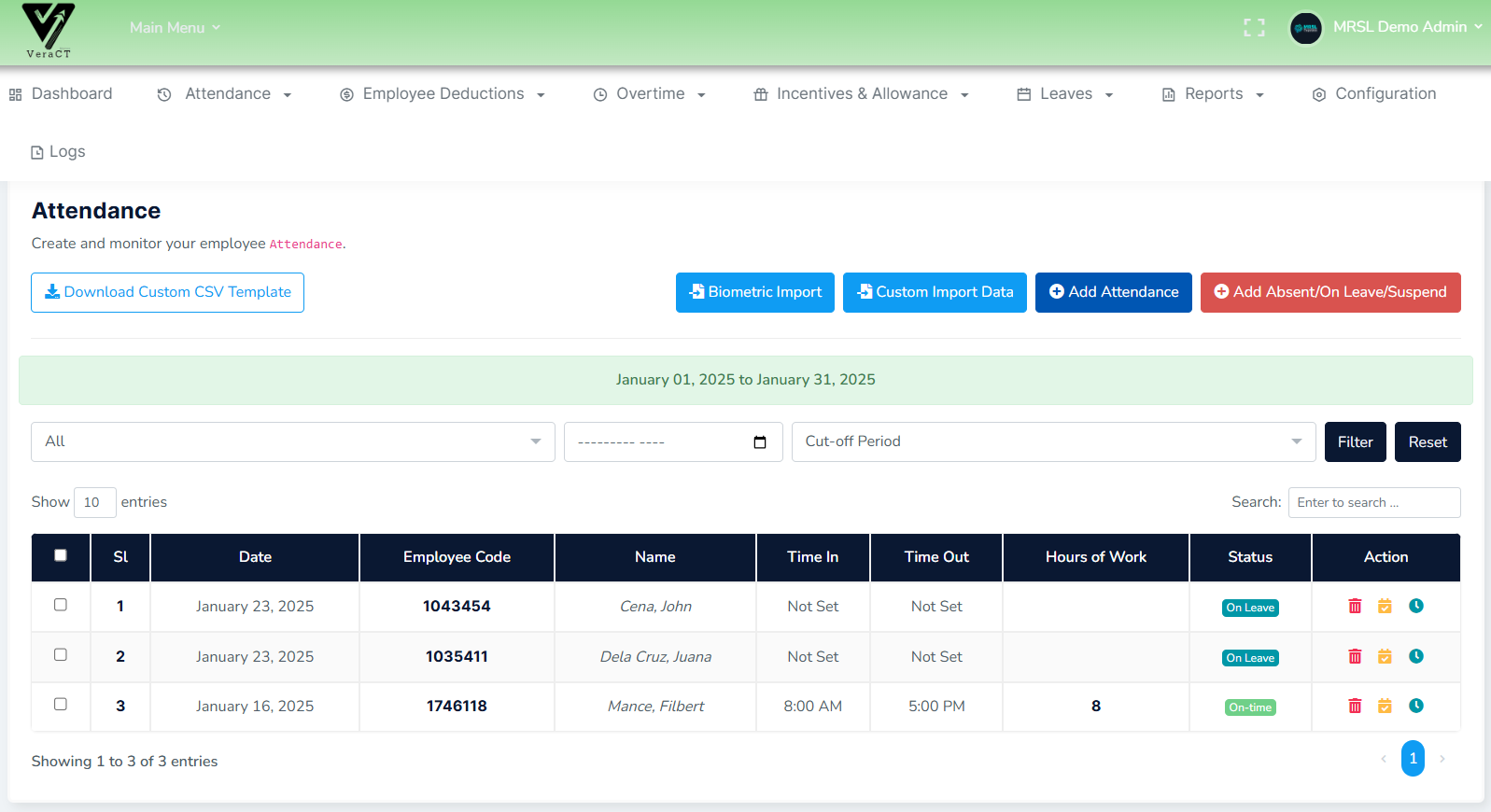

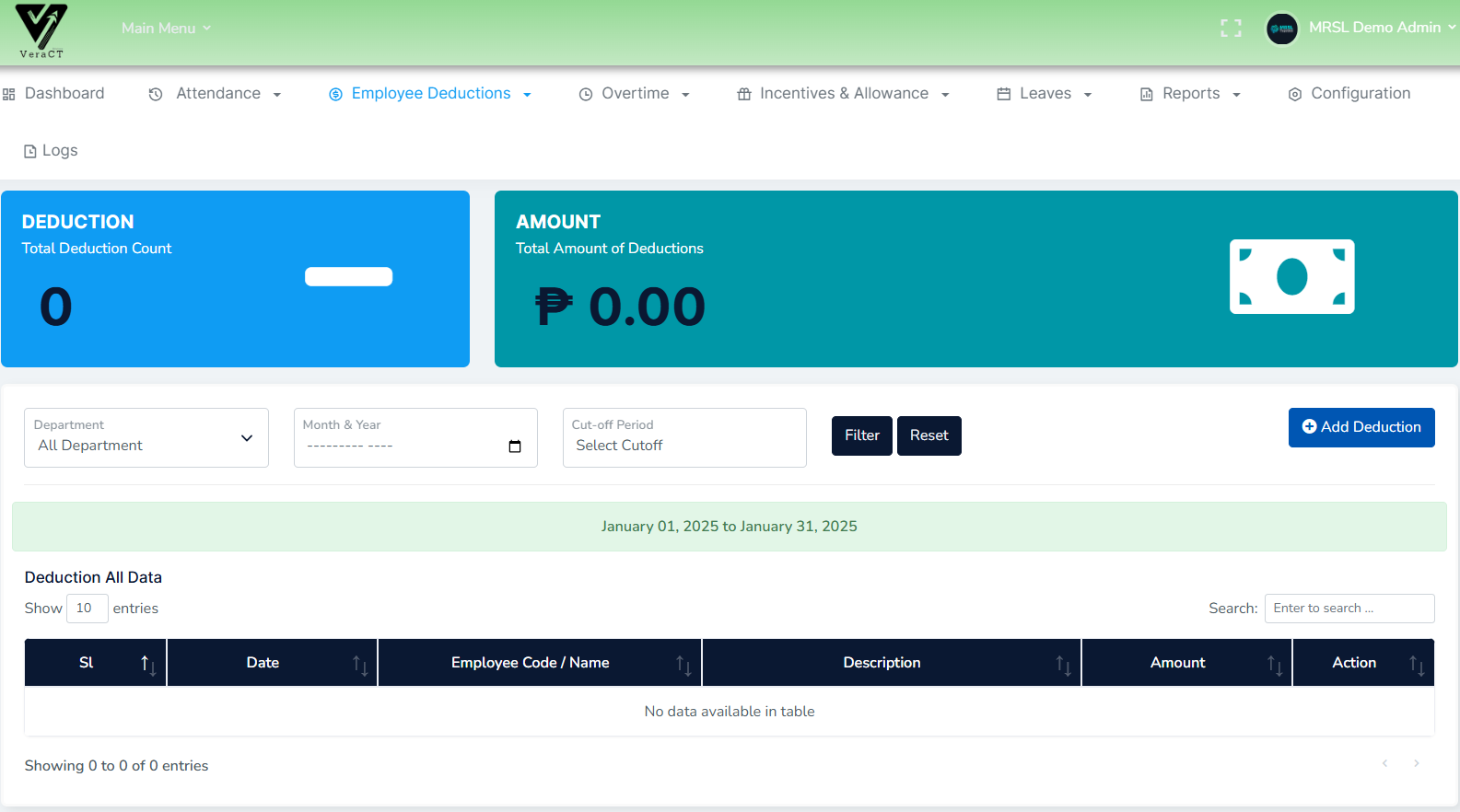

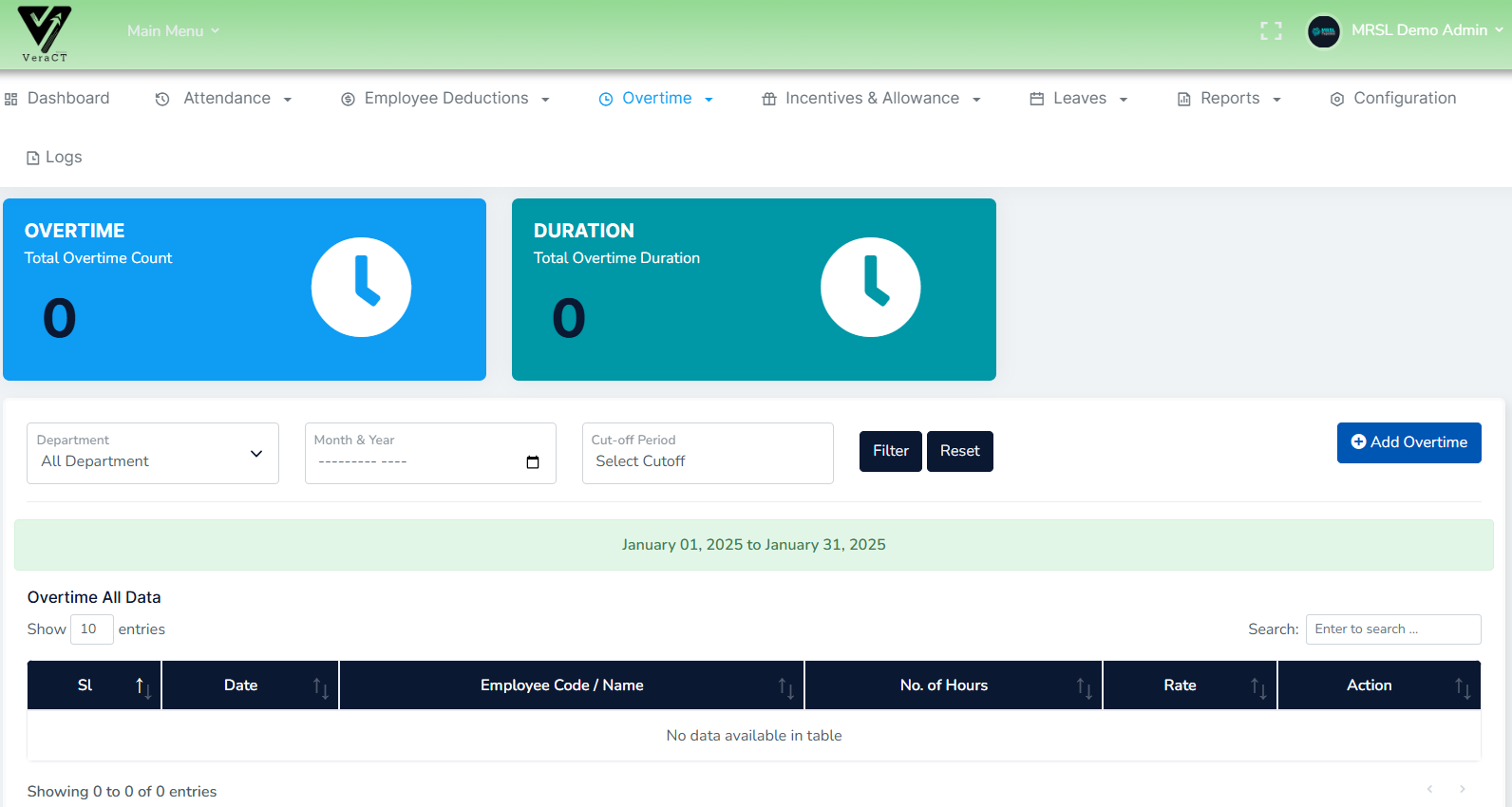

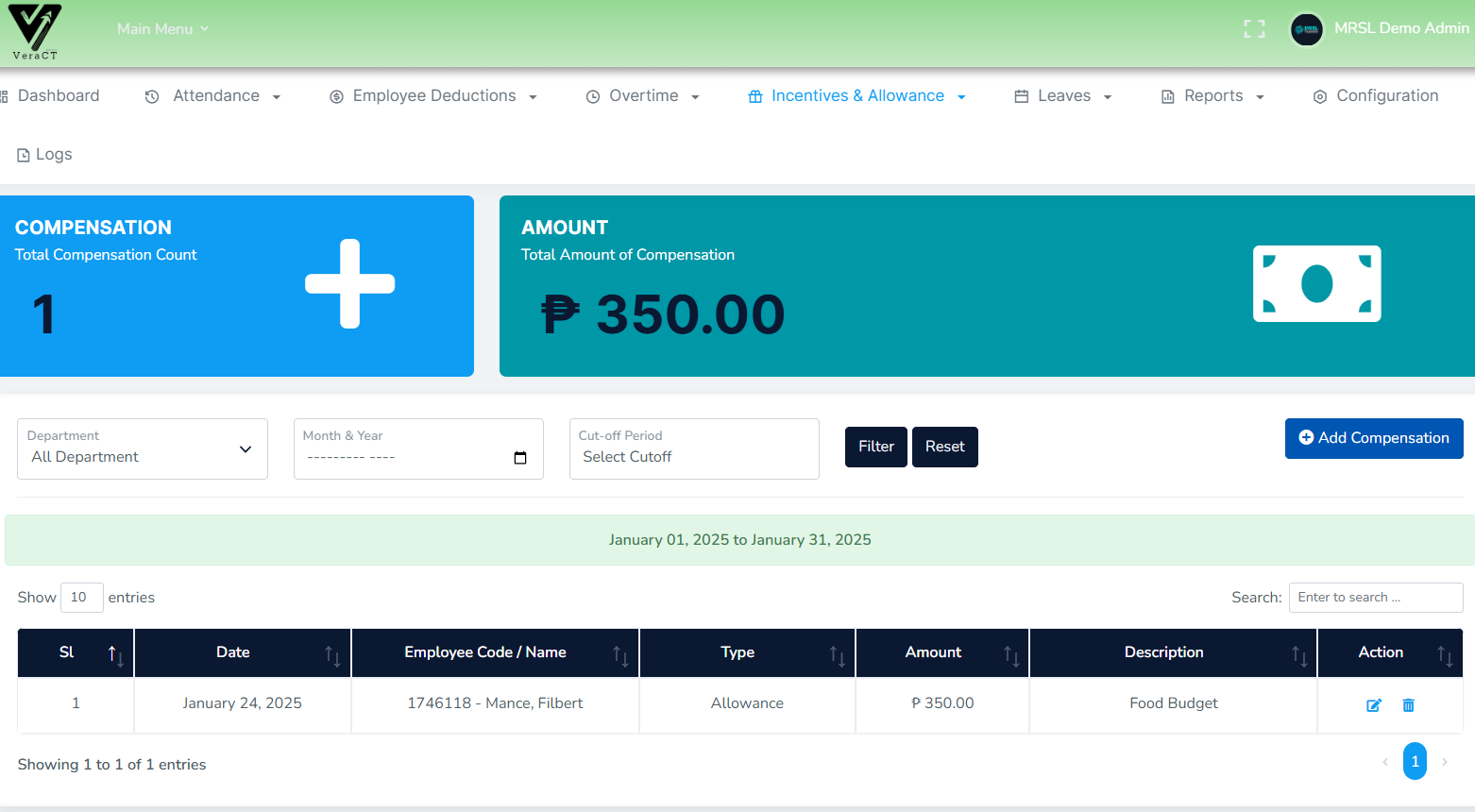

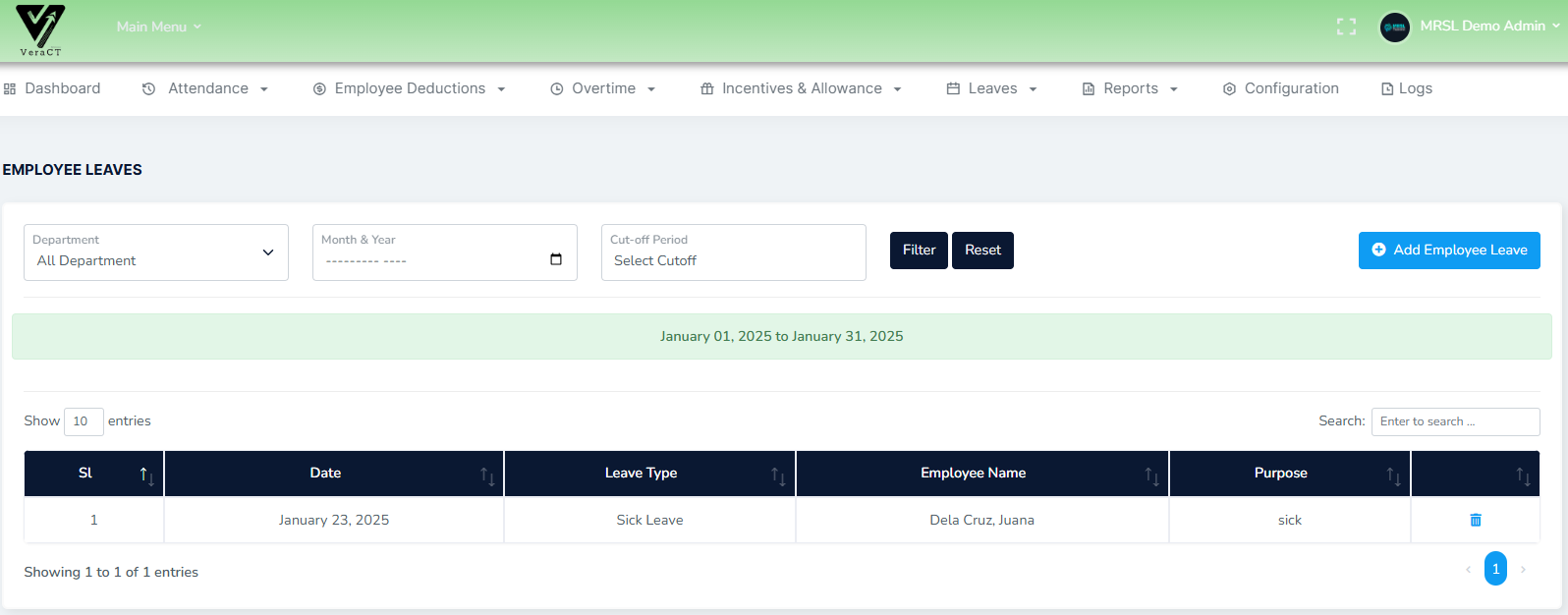

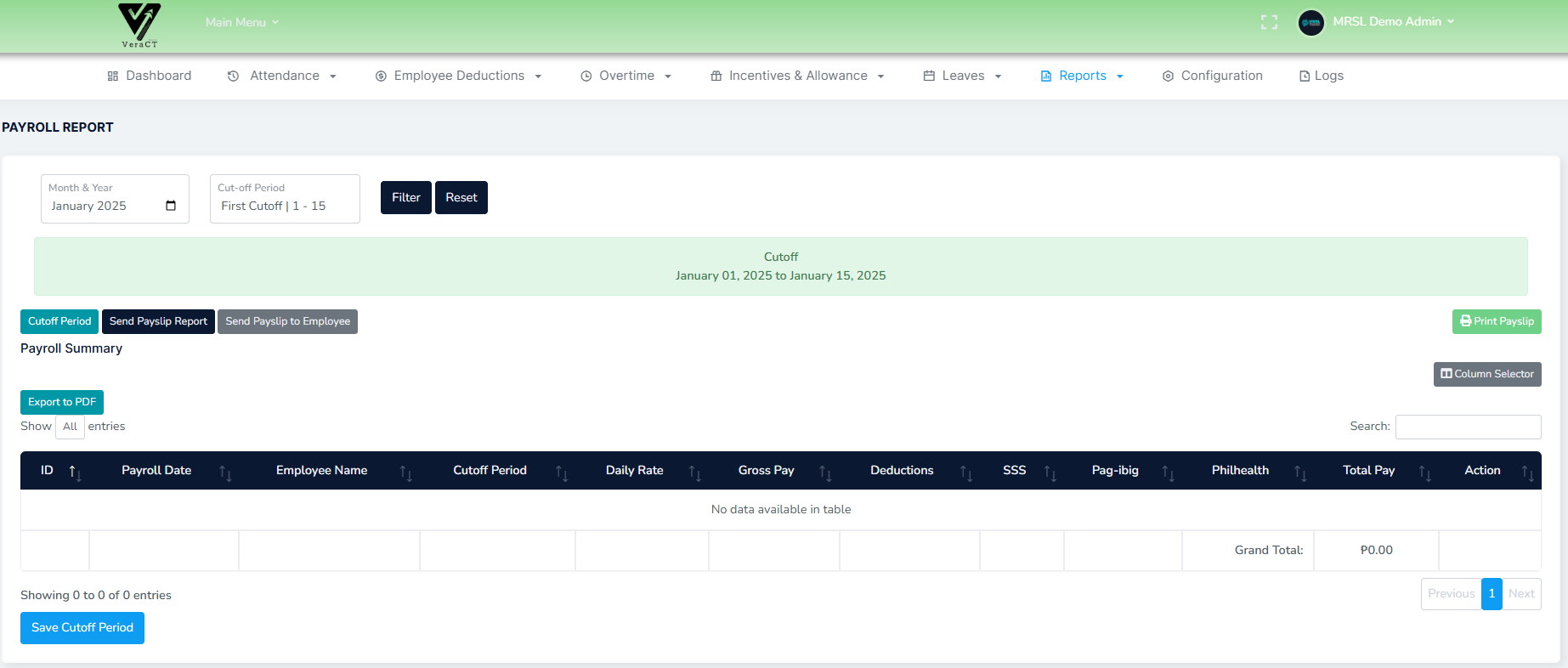

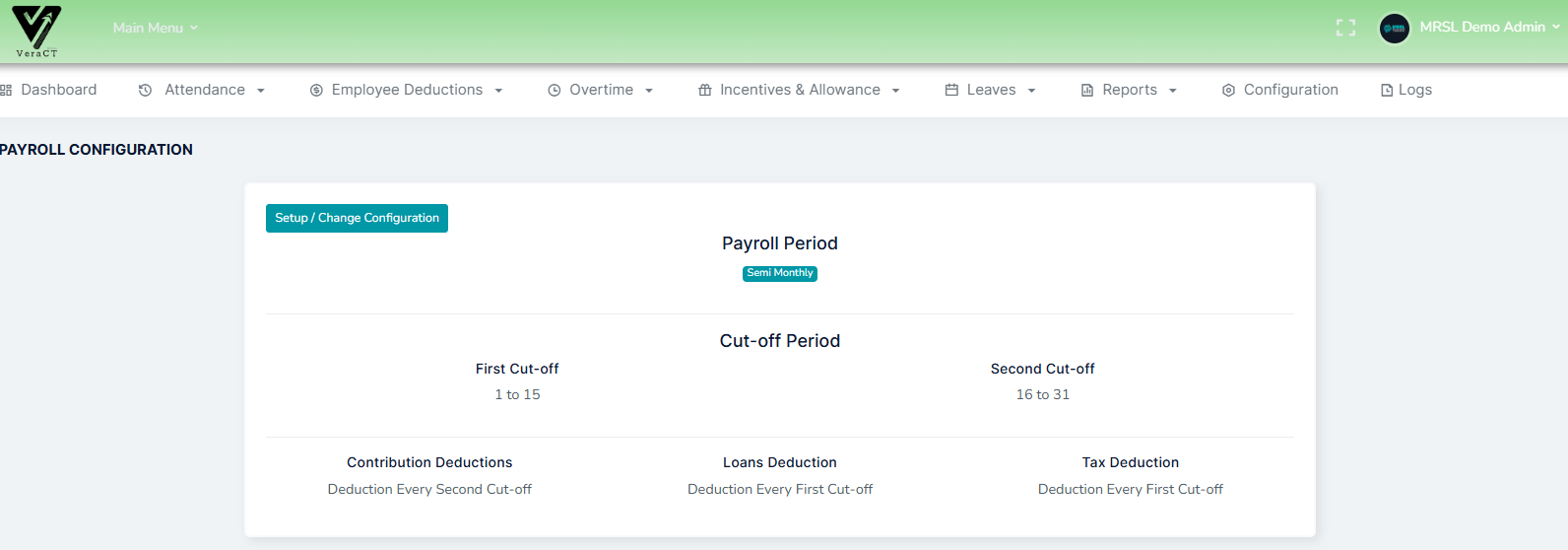

A critical component of an organization's Human Resources (HR) and Accounting systems that automates, manages, and tracks employee compensation, deductions, benefits, and tax calculations. It simplifies payroll processing, ensures compliance with tax laws, and provides employees with accurate and timely paychecks.

This module is designed to enhance efficiency, reduce errors, and maintain transparency in managing employee salaries, bonuses, and other financial benefits.