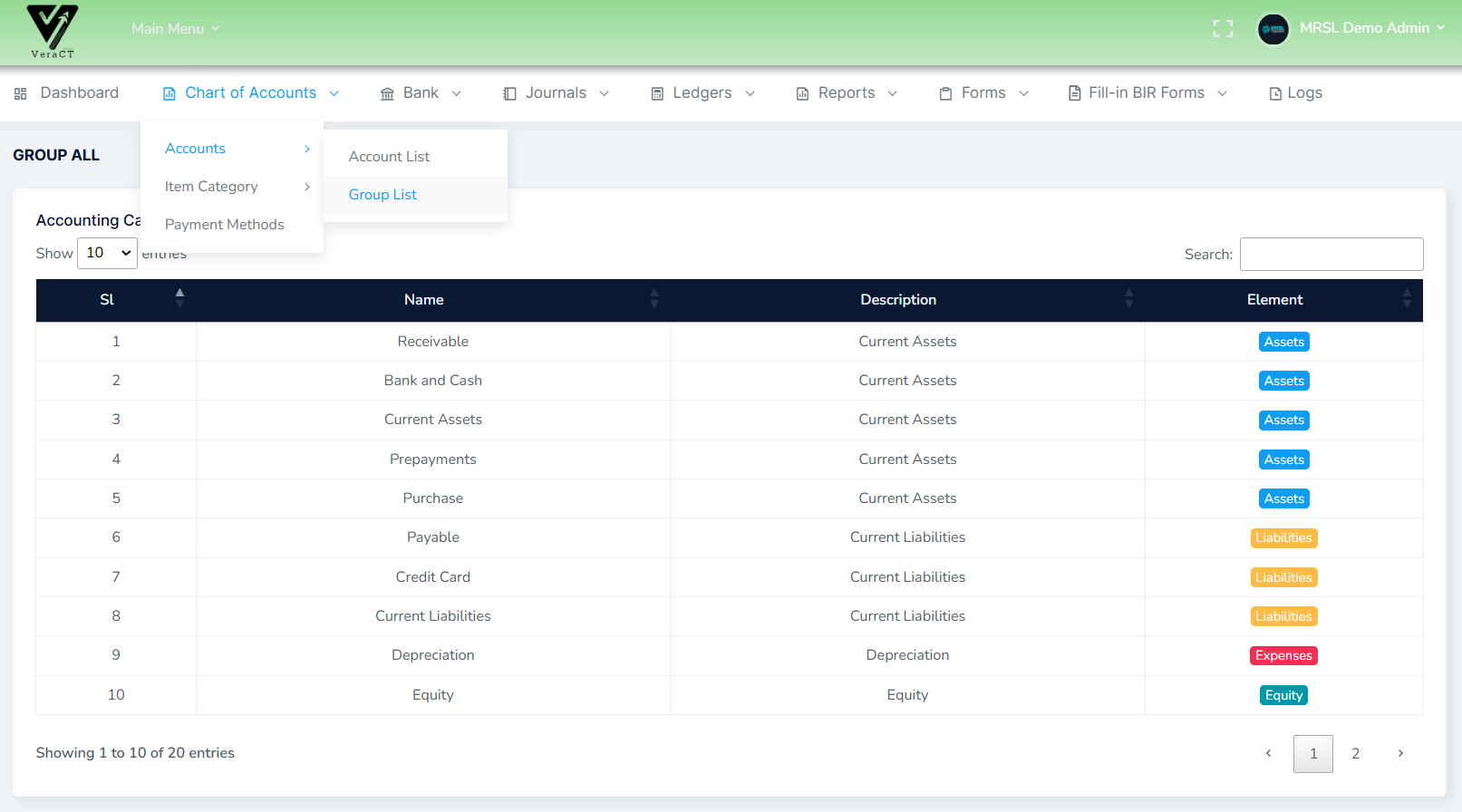

Chart Of Accounts

A structured listing of all the accounts used by an organization in its accounting system. It serves as the foundation for recording financial transactions,

organizing them by category, and ensuring accurate financial reporting. The COA helps accountants and financial professionals categorize,

track, and manage an organization’s financial activities.

The structure of a COA allows the company to organize transactions in a way that is easy to track, report, and analyze.

The numbering system in the COA is typically hierarchical, with broader categories having larger numbers, and more specific accounts having smaller numbers

(e.g., 1000 for assets, 2000 for liabilities, etc.).

A well-organized COA ensures clarity, supports financial analysis, and is crucial for accurate and consistent reporting.